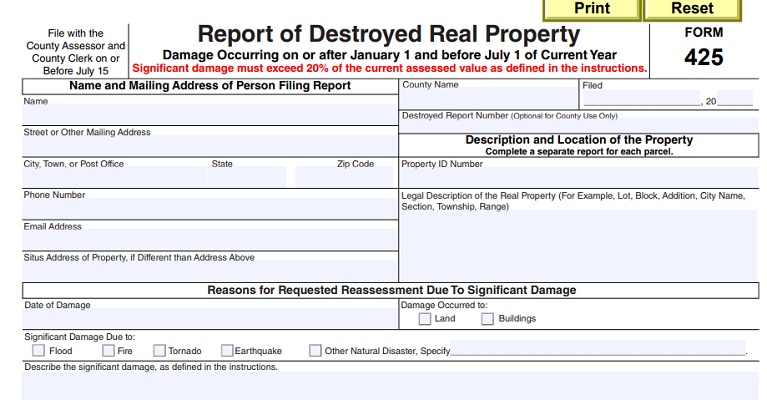

LINCOLN — The Department of Revenue, Property Assessment Division, announces that a new form has been created (Report of Destroyed Real Property, Form 425), pursuant to 2019 Neb. Law LB 512. Please review the instructions on the Form 425.

The Form 425 is to be used by owners of real property whose property has suffered significant property damage as a result of a calamity occurring on or after January 1 and before July 1 of the current assessment year. The property owner may file the Form 425 with the county assessor and the county clerk on or before July 15.

A calamity is defined as a disastrous event, including, but not limited to, a fire, an earthquake, a flood, a tornado, or other natural event which significantly affects the assessed value of the property. Destroyed real property does not include property suffering significant property damage that is caused by the owner of the property.

Significant property damage means –

- Damage to an improvement exceeding 20% of the improvement’s assessed value in the current tax year as determined by the county assessor;

- Damage to the land exceeding 20% of a parcel’s assessed land value in the current tax year as determined by the county assessor; or

- Damage exceeding 20% of the property’s assessed value in the current tax year as determined by the county assessor if:

a. The property is located in an area that has been declared a disaster area by the Governor and

b. A housing inspector or health inspector has determined the property is uninhabitable or unlivable.

The county board of equalization will consider the report to determine any adjustments to the assessed value of the destroyed real property for the current year.

The county board of equalization must act upon this report on or after June 1 and on or before July 25, or on or before August 10 if the board has adopted a resolution to extend the deadline for hear protests under Neb. Rev. Stat. § 77-1502, and must send a notice of the reassessment value for the destroyed real property to the property owner.